Caroline Ellison Net Worth: The Rise and Collapse of a Crypto Executive’s Fortune

Before the collapse of FTX in late 2022, Caroline Ellison was a rising star in the cryptocurrency world. As CEO of Alameda Research, she stood at the helm of one of the most influential trading firms in crypto—and her personal wealth, on paper, soared into the hundreds of millions. But after the public unraveling of FTX and the charges brought against its executives, everything changed. So what is Caroline Ellison’s net worth in 2025? The answer is far from simple and reflects one of the biggest financial implosions of the decade.

What Is Caroline Ellison’s Net Worth in 2025?

As of 2025, Caroline Ellison’s net worth is estimated to be close to $0, or possibly in negative territory depending on legal judgments, asset seizures, and restitution requirements. While she was once reported to have a paper net worth exceeding $100 million due to her role at Alameda and association with FTX’s wealth, most of that was based on inflated valuations and illiquid crypto holdings that have since been wiped out.

The downfall of FTX exposed massive financial mismanagement, and Ellison has since pleaded guilty to several criminal charges, including wire fraud and conspiracy. As part of her cooperation with prosecutors, she may have forfeited assets and could face financial penalties that further erode any remaining wealth.

How Was Her Net Worth Built Before the Collapse?

1. Equity and Compensation at Alameda Research

Caroline Ellison was appointed co-CEO of Alameda Research in 2021 and later became the sole CEO. Alameda served as the trading arm of FTX, and the two entities were tightly intertwined. Ellison’s compensation included salary, bonuses, and significant equity in Alameda, whose valuation—before the collapse—was estimated to be in the billions.

While it’s unclear exactly how much equity she held, reports suggest that key executives were granted substantial ownership stakes. At its peak, her paper wealth—based on those internal valuations and crypto holdings—may have reached $100–150 million. However, none of that wealth was likely realized in fiat currency, and the valuation crumbled as FTX’s fraudulent structure was exposed.

2. Crypto Holdings and Token Exposure

As CEO of Alameda, Ellison had exposure to major crypto assets like FTT (FTX’s native token), SOL (Solana), and various DeFi tokens. Many of these holdings were used as collateral in highly leveraged trades. When crypto markets crashed and the liquidity crisis hit in 2022, these tokens lost most of their value—erasing hundreds of millions from Alameda’s books.

Ellison herself likely held large quantities of FTT and other assets tied to FTX’s ecosystem, but those holdings became worthless nearly overnight. For someone whose net worth was closely tied to speculative tokens and private equity in a now-defunct company, the drop was catastrophic.

3. Lack of Diversification

Ellison’s wealth wasn’t diversified across industries or asset classes. It was almost entirely rooted in crypto, and specifically in one company’s ecosystem. That left her vulnerable to the exact kind of implosion that occurred—making her net worth extremely volatile and ultimately unsustainable.

Unlike traditional tech executives who invest in real estate, stocks, or startups, Ellison’s holdings were largely tied up in the opaque and unstable world of crypto arbitrage, lending, and DeFi strategies. When the trust in that system collapsed, her net worth did too.

What Happened After the FTX Collapse?

1. Criminal Charges and Cooperation Agreement

In December 2022, Caroline Ellison was charged with multiple federal crimes, including conspiracy to commit wire fraud, securities fraud, and money laundering. She quickly pleaded guilty and entered into a cooperation agreement with U.S. prosecutors—admitting to knowingly misusing customer funds from FTX to cover trading losses at Alameda.

As part of her plea deal, she agreed to forfeit assets, cooperate with investigators, and testify in the case against FTX founder Sam Bankman-Fried, who was later convicted in 2023. Her guilty plea and cooperation helped reduce potential prison time, but it likely meant surrendering any remaining financial assets tied to her role in the fraud.

2. Asset Forfeiture and Legal Consequences

While specific details about asset seizure have not been made fully public, the Department of Justice typically requires forfeiture of any ill-gotten gains. Given the billions in customer funds lost, Ellison—along with other top executives—may be on the hook for restitution or civil judgments if courts determine her actions directly contributed to investor losses.

Even if she had managed to cash out some crypto before the collapse, those funds may have been seized or placed in escrow pending legal outcomes. In essence, her net worth was not just wiped out by the market crash—it was legally dismantled as part of criminal restitution and penalties.

3. Future Employment Prospects

With felony convictions on her record and massive public scrutiny, Ellison’s career in finance or tech is likely over—at least in any traditional sense. While she may be able to work again in a private capacity someday, any significant income-generating role is unlikely for the foreseeable future. That further limits her ability to rebuild a net worth in the short term.

Some convicted white-collar criminals have gone on to write books, consult, or lecture on ethics, but even those opportunities are limited, especially when the damage is as widespread as the FTX case. For now, rebuilding wealth appears improbable, and her future may be constrained by legal supervision and public reputation.

How Does Her Net Worth Compare to Other FTX Executives?

Caroline Ellison’s financial trajectory mirrors that of others in the FTX inner circle. Sam Bankman-Fried’s net worth, once estimated at $26 billion, plummeted to nearly zero within days of the collapse. Nishad Singh and Gary Wang—two other high-ranking FTX executives—also lost millions in equity and faced criminal charges and asset forfeiture.

In that context, Ellison is not alone. What sets her apart is the speed of her cooperation with prosecutors and the central role she played in explaining the financial structure of Alameda and FTX. Her testimony was instrumental in convicting SBF—but it came at the cost of her own fortune and future.

Final Thoughts

Caroline Ellison’s net worth in 2025 serves as a cautionary tale about speculative wealth, unchecked ambition, and the dangers of operating in unregulated financial ecosystems. What once looked like a rapid rise to fortune ended in criminal charges, financial ruin, and lasting reputational damage. Her story isn’t just about the loss of money—it’s about the ethical and systemic collapse of a once-celebrated crypto empire.

For now, her net worth may sit at zero, but the broader cost of her choices—measured in legal consequences and lost credibility—will likely follow her for years to come.

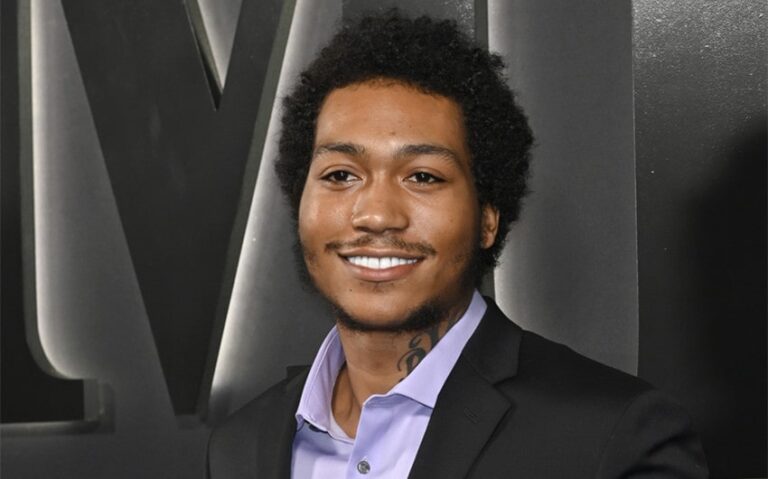

image source: https://www.cnbc.com/2023/10/11/caroline-ellison-said-sbf-considered-raising-from-mbs-to-repay-ftx.html