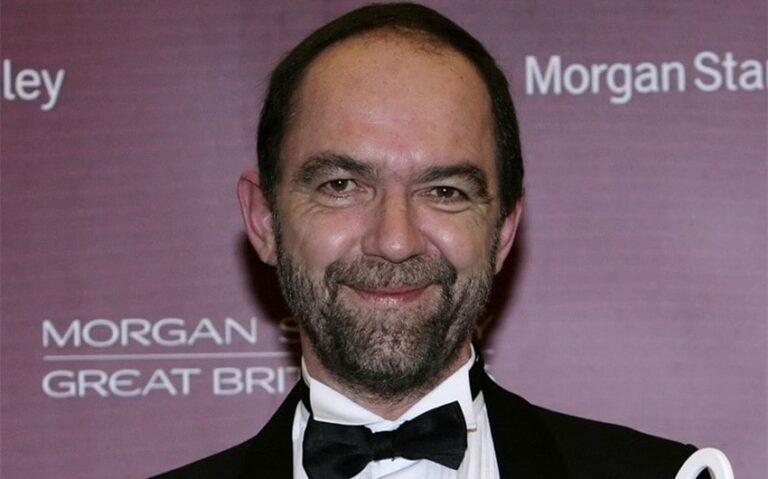

David Solomon Net Worth in 2025: Goldman Sachs CEO’s Wealth, Income, and Career Power

You might know David Solomon as the DJ with a day job—but if you’re asking what his net worth looks like, you’re stepping into the world of one of the most powerful finance executives alive. As the CEO and chairman of Goldman Sachs, Solomon holds one of the highest-profile positions on Wall Street. But how much wealth does a job like that actually bring? Let’s break down David Solomon’s net worth in 2025 and see how he built his financial empire.

What Is David Solomon’s Net Worth in 2025?

As of 2025, David Solomon’s net worth is estimated to fall between $85 million and $200 million. The wide range reflects the complexity of executive compensation—where base salary is just one piece of a much larger puzzle. His fortune is the result of over two decades at Goldman Sachs, significant stock holdings, performance bonuses, real estate investments, and a surprising musical side gig that has built his personal brand.

How Did David Solomon Build His Fortune?

You might assume that all of Solomon’s money came from his job title alone. But that’s only part of the story. His rise began in investment banking, where he earned millions long before he became CEO. He joined Goldman Sachs in 1999 as a partner—an elite status that came with shares and profit-sharing. He later served as co-head of the Investment Banking Division and president before becoming CEO in 2018. Each promotion boosted not just his salary, but his long-term equity.

In the world of high finance, wealth is measured more by stock options and performance bonuses than annual paychecks. Solomon’s total compensation consistently ranked among the highest in the financial industry, even compared to peers at JPMorgan or Morgan Stanley.

A Breakdown of His Compensation Packages

To understand his net worth, you need to examine how his pay is structured:

- Base Salary: Roughly $2 million annually—comparable to other bank CEOs.

- Annual Cash Bonus: In 2024, he received $8.3 million in cash bonuses.

- Equity Awards: He earned stock-based awards valued at nearly $29 million in 2024 alone.

- Retention Package: In 2021, Goldman granted him a $30 million retention bonus to be vested over five years. By 2025, he has unlocked most of that equity.

Across several years, these packages have added tens of millions to his long-term holdings, with stock values rising or falling based on the performance of Goldman Sachs. That direct tie to the firm’s success gives Solomon strong incentives—and explains how his wealth has multiplied.

How Much Stock Does David Solomon Own?

Solomon owns approximately 150,000 shares of Goldman Sachs stock as of 2025. With GS stock trading at around $600 per share, that stake is worth over $90 million—and rising. Over the last five years, Goldman’s stock price has increased due to its pivot toward consumer banking, fintech investments, and asset management growth. As CEO, Solomon has benefited handsomely from those gains.

His shares come from equity awards, performance incentives, and reinvestment. These holdings not only reflect his personal net worth but also reinforce trust from investors—who view a CEO’s stake in the company as a measure of alignment with shareholder interests.

DJ D-Sol: A Lucrative Side Venture?

You may have heard of David Solomon’s alter ego, DJ D-Sol. At first glance, it seems like a quirky hobby. But his music career has turned into a surprisingly valuable side brand. He’s played at high-profile events, including Tomorrowland and private hedge fund galas. In 2023, his song “Someone Like You” climbed Spotify’s electronic music charts, drawing millions of streams.

Although the earnings from his DJ gigs are modest compared to his finance role, he does make money from:

- Performance fees (rumored to range from $10K–$100K per set)

- Music royalties from streaming

- Brand collaborations with fashion and tech firms

More importantly, his music persona enhances his visibility, making him one of the most recognized executives globally—which can translate into business leverage and additional board opportunities.

Real Estate and Luxury Assets

Solomon has invested heavily in real estate, owning multiple high-value properties. He previously sold a penthouse on Manhattan’s Upper West Side for over $30 million. He also owns a lavish home in Aspen, Colorado, a known retreat for financial elites.

These properties serve dual purposes—personal luxury and appreciating assets. Real estate plays a defensive role in his portfolio, balancing out the volatility of equity-based wealth. When combined with fine art and collectible investments, they add an estimated $20–30 million to his net worth.

Leadership Impact on Goldman Sachs’ Valuation

As CEO, Solomon’s strategic decisions directly affect Goldman’s market valuation. Under his leadership, the bank has expanded its consumer platform (Marcus), modernized tech infrastructure, and entered the fintech space with initiatives like the Apple Card partnership. These moves contributed to a stronger balance sheet and higher shareholder confidence.

Every increase in Goldman’s stock price grows Solomon’s equity value. When the company performs well, his personal net worth grows automatically—just one of the ways his wealth is tied to corporate success.

Lifestyle and Financial Habits

Solomon is known for his disciplined lifestyle, despite his DJ persona. He avoids excessive luxury flaunting, focuses on philanthropy, and maintains a low personal debt profile. His frugal but smart approach to money management helps preserve wealth in an industry often criticized for its excess.

He reportedly reinvests much of his income, holds a diversified portfolio outside of Goldman stock, and uses financial advisors to manage long-term estate planning. This professional approach to wealth management helps explain why his net worth remains stable and steadily rising.

Philanthropy and Civic Engagement

Solomon serves on the board of the Robin Hood Foundation, a prominent nonprofit aimed at fighting poverty in New York. He also supports education-based charities, music programs for youth, and public health causes.

While philanthropic donations reduce taxable income, they also contribute to his public reputation as a well-rounded leader. This social capital can influence his selection for future board roles or business opportunities after his Goldman tenure ends.

Controversies and Public Scrutiny

No executive career is without scrutiny. Solomon has faced criticism over issues such as Goldman’s involvement in the 1MDB scandal (although the firm settled and he was not personally implicated) and for executing job cuts during market downturns. He’s also received backlash over executive pay increases during leaner times for employees.

However, none of these controversies appear to have impacted his compensation or career trajectory. In fact, many shareholders appreciate his aggressive approach to cost control and strategic expansion, both of which have enhanced Goldman’s profitability—and by extension, his personal wealth.

What’s Next for David Solomon?

At 63, Solomon is approaching the age when many Fortune 500 executives step aside. While no exit plan has been officially announced, speculation suggests he may retire within the next 3–5 years. If that happens, he’s likely to walk away with a final package worth $50–75 million, including vested options, severance, and deferred compensation.

Post-Goldman, he may explore:

- Private equity leadership

- Board seats at fintech or media companies

- Philanthropic foundations

- Even full-time DJing, if rumors are true

Whatever his next chapter, his financial future looks secure—if not even more expansive.

Final Thoughts: David Solomon’s Net Worth Reflects Strategic Leadership

David Solomon’s estimated net worth of $85 to $200 million in 2025 represents more than executive privilege. It’s the result of long-term strategy, equity leverage, and diversified income across traditional and unconventional paths. Whether you admire his business acumen or his boldness in blending finance with music, you can’t ignore the financial success story.

As you consider your own journey, Solomon’s story offers a lesson in patience, performance, and creative reinvention. From boardrooms to DJ booths, his net worth reflects not just wealth—but adaptability in a changing world.

image source: https://www.bizjournals.com/newyork/news/2023/01/27/goldman-sachs-ceo-david-solomon-gets-29-pay-cut.html